Home

Salary Calculator California Vs Florida . See how we can help improve your knowledge of math, physics, tax, engineering and more. Your employer withholds a 6.2% social security tax and a 1.45% medicare tax from your earnings after each pay period.

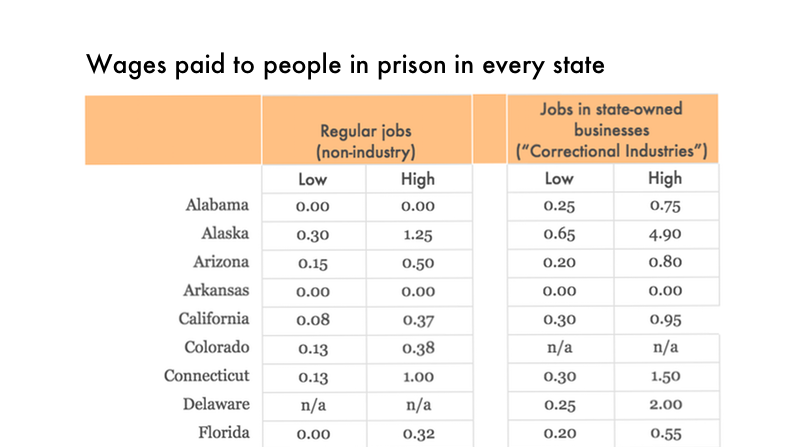

How Much Do Incarcerated People Earn In Each State Prison Policy Initiative from static.prisonpolicy.org For income taxes in all fifty states, see the income tax by state. Wage data are updated on good calculators annually. Below are your federal salary paycheck results. This marginal tax rate means that your immediate additional income will be taxed at this rate. Consumer prices including rent in united kingdom are 7.56% lower than in united states.

This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. 2021 cost of living calculator: Health savings account, bonuses, profit sharing, vacation, paid time off, paid sick days, maternity/paternity leave, etc. A salary of $100,000 in orlando, florida should increase to $173,577 in los angeles, california (assumptions include homeowner, no child care, and taxes are not considered. To use our california salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. For example, if the cost of living is higher in your new city, then you would need to earn more income to maintain the same quality of life you currently enjoy. Living wage calculation for florida.

Source: wageadvocates.com This places us on the 4th place out of 72 countries in the international labour organisation statistics for 2012. Your employer withholds a 6.2% social security tax and a 1.45% medicare tax from your earnings after each pay period. Make an informed decision before relocating.

This tool compares the tax brackets for single individuals in each state. How to calculate net income. The salary calculator will compare the cost of living in each city, and display the amount that you would need to earn.

This marginal tax rate means that your immediate additional income will be taxed at this rate. The tool provides information for individuals, and households with one or two working adults and. The average monthly net salary in the united states is around 2 730 usd, with a minimum income of 1 120 usd per month.

Source: www.ncsl.org After a few seconds, you will be provided with a full breakdown of the tax you are paying. Enter your annual salary or earnings per pay period. Restaurant prices in united kingdom are 7.59% higher than in united states.

Rent prices in united kingdom are 22.37% lower than in united states. The cost of living is usually captured in what is known as the consumer price index or cpi. Compare the cost of living in novato, california against another us cities and states.

This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. Do you offer health, vision, or dental insurance? We help you decide by comparing all the largest.

Source: farmdocdaily.illinois.edu This number is an aggregate of the various expense categories for people to live their lives. Use salary.com's cost of living calculator to easily compare the cost of living in your current location to the cost of living in a new location. A salary of $29,000 in orlando, florida could decrease to $25,362 in california city, california (assumptions include homeowner, no child care, and taxes are not considered.

2021 cost of living calculator: See how we can help improve your knowledge of math, physics, tax, engineering and more. Make an informed decision before relocating.

We use the consumer price index (cpi) and salary differentials of over 300+ us cities to give you a comparison of costs and salary. The united states salary comparison calculator allows you to quickly compare several salaries adjacent each other to see the best salary after tax including federal state tax, medicare deductions, social security, capital gains and other income tax and salary deductions complete with supporting income tax tables. Compare the cost of living in novato, california against another us cities and states.

Source: prod.gusto-assets.com For more information about the income tax in these states, visit the california and florida income tax pages. Earnings over $200,000 will be subject to an additional medicare tax of 0.9%, not matched by your employer. This number is an aggregate of the various expense categories for people to live their lives.

Earnings over $200,000 will be subject to an additional medicare tax of 0.9%, not matched by your employer. Visit global mobility solutions for more information on corporate relocation services. This number is an aggregate of the various expense categories for people to live their lives.

Visit global mobility solutions for more information on corporate relocation services. The results are broken up into three sections: A salary of $29,000 in orlando, florida could decrease to $25,362 in california city, california (assumptions include homeowner, no child care, and taxes are not considered.

Source: static.fundingcircle.com This marginal tax rate means that your immediate additional income will be taxed at this rate. This tool compares the tax brackets for single individuals in each state. Bureau of labor statistics and contain salary information for 900 different occupations across the united states.

To get started, simply enter the new city name and select your. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The result is based on the salaries and hourly rates reported by people with similar jobs in your city.

Enter your annual salary or earnings per pay period. The california salary comparison calculator allows you to quickly calculate and compare upto 6 salaries in california or compare with other states for the 2021 tax year and historical tax years. This calculator is intended for use by u.s.

Source: frla.org Your average tax rate is 22.0% and your marginal tax rate is 39.7%. For more information about the income tax in these states, visit the california and florida income tax pages. Compare the cost of living in novato, california against another us cities and states.

See what you'll need to earn to keep your current standard of living wherever you choose to work and live. Let us help you make an informed decision about what it will cost to live and work in the city of your dreams! A salary of $29,000 in orlando, florida could decrease to $25,362 in california city, california (assumptions include homeowner, no child care, and taxes are not considered.

One of a suite of free online calculators provided by the team at icalculator™. For more information about the income tax in these states, visit the california and florida income tax pages. Orlando, florida vs los angeles, california.

Thank you for reading about Salary Calculator California Vs Florida , I hope this article is useful. For more useful information visit https://labaulecouverture.com/